An Introduction to Futures Trading

This page is designed to provide an introduction to the futures market in general and the INE EC container freight futures contract in particular. We will introduce the concept of Container Freight Index Futures (CoFIF), the INE EC contract, key aspects of regulated futures markets as well as different approaches to trading for speculative and hedging purposes

CoFIF Market Background

The idea of establishing a container freight futures contract to allow market participants to protect themselves against adverse price changes is nothing new, with the first attempt to establish such a contract dating back to the 2000s. However, to date, no such contract has succeeded.

Back in 2011, the Shanghai Shipping Freight Exchange (SSFE) launched their Container Freight Derivatives (CFD) contract, the most promising attempt so far. It saw some initial interest from speculative traders, but there was little industry participation and trading was limited to domestic Chinese companies.

Most importantly, the SSFE was not a regulated futures exchange and thus lacked an established ecosystem of brokers and traders and the contract was ultimately suspended in 2016 as trading volume quickly dropped off.

Any successful container freight futures contract needs to overcome three distinct challenges to have a realistic shot at becoming an industry benchmark: liquidity, counterparty risk and transparency.

Liquidity

Firstly, major industry participants like carriers would need to hedge large quantities if they were to rely on benchmark contracts for pricing. They would need to be able to get in and out of their positions easily without affecting the entire market. However, if the market is too small, it becomes impossible to trade the necessary volume without causing wild price swings that would disrupt the entire market and ultimately make any attempt at hedging futile.

A lack of liquidity has so far hamstrung the success of the CME and SGX futures based on the Baltic Exchange's FBX11 index. Neither speculators nor hedgers have been willing to take the first step so far and establish initial positions. Hence, bid-ask spreads remain wide, making it challenging to enter and exit positions at the market price.

Much of the speculative trading interest in container freight contracts is located in China, and with limited access to overseas futures exchanges, international contracts may struggle to attract them to get a new contract off the ground and establish sufficient liquidity for industry participants to join.

Counterparty Risk

Secondly, any market needs to be properly regulated and safeguarded to ensure that contracts can be enforced and each market participant can be confident that their counterparty can't simply walk away from an unfavourable trade. This is where established futures exchanges have a distinct advantage: While marketplaces like the SSFE may call themselves 'exchanges', they are not the same as regulated futures exchanges.

Futures exchanges are strictly supervised by market regulators and have a variety of tools in place to compensate market participants in case any traders default on their obligations, including investor protection funds, initial margins and daily price limits. Most importantly, regulated futures markets rely on a centralised clearinghouse to novate all trades, that is, to act as the legal counterparty for every buyer and seller and thereby guarantee the performance of all contracts traded on the exchange.

Transparency

Lastly, any contract needs to be transparent and properly reflect the underlying reality of the physical market as futures prices cannot be dictated by unpredictable speculative traders and thus removed from the actual spot market price. Unless hedgers can trust the futures market to be tethered to the physical market, they will not be able to use it to protect themselves from volatile shipping rates.

The INE EC Contract

The Shanghai International Energy Exchange (INE) launched its Containerized Freight Index (Europe Service) futures contract in August 2023 with the intention of overcoming the aforementioned challenges and establish a benchmark contract for the Shanghai - North Europe route. Commonly referred to as CoFIF, short for Container Freight Index Futures, or EC, its official exchange product code, the futures contract is different from its predecessors in several ways.

Based on Paid Spot Market Rates

The CoFIF contract is cash settled against the Shanghai Shipping Exchange (SSE) Shanghai Export Containerized Freight Index based on Settled Rates (SCFIS) Shanghai - North Europe route index. Launched during the Covid-pandemic as shipping rates surged to record levels, the index is based on the actual rates paid for containers exported from Shanghai to Hamburg, Rotterdam, Antwerp, Felixstowe and Le Havre, with settled prices submitted to the SSE after the departure of the vessel.

Thus, the contract's final (settlement) price is determined by the real prices paid in the underlying container freight spot market, avoiding the oft-cited concern by industry participants that the market may be overrun or broken by speculators and linking it tightly to the physical market.

A Mandate to Serve the Real Industry

From the day it was launched, the market reception of the new contract was exceptionally strong, with total daily turnover routinely exceeding USD 1bn. The Red Sea crisis then turbocharged interest in CoFIF trading as China - Europe rates rose dramatically following the blockade of the Suez Canal.

This primarily brought new speculative traders into the market, but, given the INE's government-issued mandate to serve the real industry, it quickly took action to rein in excessive speculation by raising margins and reducing daily new open position limits for speculative traders.

Risk Management

Due to the strong regulatory overview it has of the market, the INE was able to distinguish between hedgers and speculators and enact targeted measures to maintain a stable market environment. The immediate result was a drop-off in daily trading volume as speculative trading became more capital-intensive, but the futures market was prevented from drifting too far away from the underlying spot market.

As the market gradually priced in the existing disruptions, the restrictions were loosened and volumes quickly picked up again. The industry-first approach of the Chinese exchanges means they are willing to forego fee income from speculators to maintain an orderly market, and industrial hedgers tend to benefit from reduced initial margin requirements and exemptions from standard position limits to account for their hedging needs.

In addition to these pro-active risk management measures by the exchange, INE market participants are also covered by the China Futures Market Monitoring Centre (CFMMC)-managed Futures Investors Protection Fund in case of defaults by traders or brokers. Thus, with its own centralised clearinghouse to novate all trades and backing from the investor protection fund, the second key challenge - proper regulation and enforcement of contracts - is also addressed by the INE's CoFIF contract.

Glossary

Hedging with CoFIF

Hedging involves taking a position in the futures market to offset a position in the physical market. Ideally, by taking an opposite position in the futures market, any loss in one market will be offset by an equivalent profit in the other market.

In reality, a perfect hedge, where any loss is precisely offset by a profit in the other market, is difficult to achieve, so hedging should instead be seen as a risk management tool that can reduce large price swings in volatile markets or lock in a fixed price.

Different market participants have different needs, so it is important to design hedging strategies in a way that suits the hedger's physical business. Hedging strategies can be designed to remove most price risk, or they can be partial and simply reduce the hedger's exposure to the spot market with a reduced exposure to the spot market price.

In the Chinese futures market, hedgers commonly benefit from reduced exchange fees, larger position limits and lower margins. This reflects both the exchanges' mandate of 'serving the real industry' and the generally lower risk-profile of hedgers, given that any potential losses are largely offset.

The following examples are simplified case studies to introduce futures as a hedging tool for the industrial users. Real applications need to take into account factors such as the hedger's risk appetite, degree of exposure to the spot market and the ability to absorb losses or pass on costs. Internal controls and risk management protocols should be in place to prevent unintended speculative trading that may expose the hedger to losses.

Hedging Example 1: Locking in a High Price as a Liner

Liners are naturally long in the physical market, benefiting from higher rates but suffering when rates fall.

Thus, if a liner has a 5,000 FEU spot rate exposure in the physical Shanghai-North Europe market in August, they may choose to lock in a rate using the futures market by selling the INE EC August contract. If the spot price falls, the liner will lose money in the physical market, but earn money in the futures market from their short position.

Assuming a current spot rate at USD 4,900 / FEU, the spot capacity sold by the liner is:

5,000 FEU × USD 4,900 / FEU × 7.24 (RMB/USD) = RMB 177,380,000

To hedge, they would then sell:

RMB 177,380,000 / 4,145 (INE EC Aug index pts) / 50 (contract multiplier) = 855.87 lots

If the spot market price then falls to 4,700 in August, the liner will make a loss in the physical market. However, since the futures market settles against the SCFIS spot market index, the INE EC contract will also drop and offset this loss.

| Date | Spot Market | Futures Market |

|---|---|---|

| May | USD 4,900 / FEU | Sold 856 lots INE EC Aug at 4145 pts |

| August | USD 4,700 / FEU | Bought 856 lots INE EC Aug at 3915 pts |

| Result | -USD 1,000,000 | USD 1,359,669 |

| Net Profit/Loss | +USD 359,669 (Note: in this example the futures market dropped -5.55% while the spot market dropped -4.1% only. While the two are linked, they may not always move equally.) | |

Hedging Example 2: Protecting against Price Hikes as a Shipper

Shippers, in contrast to liners, are naturally short in the physical market, benefiting from lower rates but suffering when rates rise.

Thus, if a shipper has a 500 FEU spot rate exposure in the physical Shanghai-North Europe market in August, they may choose to lock in a rate using the futures market by buying the INE EC August contract. If the spot price falls, the shipper will save money in the physical market, but lose money in the futures market from their long position. However, in case rates rise, they will lose money in the physical market while benefiting from their futures market profit.

Assuming a current spot rate at USD 4,900 / FEU, the spot capacity bought by the shipper is:

500 FEU × USD 4,900 / FEU × 7.24 (RMB/USD) = RMB 17,738,000

To hedge, they would then buy:

RMB 17,738,000 / 4,145 (INE EC Aug index pts) / 50 (contract multiplier) = 85.58 lots

If the spot market price then falls to 4,700 in August, the shipper will save money in the physical market. However, since the futures market settles against the SCFIS spot market index, the INE EC contract will also drop, losing the shipper money.

| Date | Spot Market | Futures Market |

|---|---|---|

| May | USD 4,900 / FEU | Sold 86 lots INE EC Aug at 4145 pts |

| August | USD 4,700 / FEU | Bought 86 lots INE EC Aug at 3915 pts |

| Result | USD 100,000 | -USD 136,602 |

| Net Profit/Loss | -USD 36,602 (Note: in this example the futures market dropped -5.55% while the spot market dropped -4.1% only. While the two are linked, they may not always move equally.) | |

Hedging Example 3: Managing Volatility as a Forwarder

Forwarders need to consider price volatility both when buying space from liners and when selling space to shippers. A successful hedge will allow the forwarder lock in fixed prices on both ends. Since INE EC futures are financially settled and do not provide cargo slots upon expiry, forwarders must sill secure cargo slots from a liner when executing a hedging strategy.

Hedging Example 3.1: Forwarders in a Rising Market

- Spot rates are rising, the market expects higher rates in August

- Liners can only offer a floating rate for August slots

- Clients want a fixed price and guaranteed slots for their cargo

- INE EC 2408 futures trade at 4651 (~$7,350)

- Latest walk-in quotations from liners are $7,500-$9500 for now

- BCOs want a fixed price and sure space for August

- Buy committed slots from liners at index-linked rate plus $50 as an added incentive for liners to honour the contract

- Buy INE EC 2408 at ~$7,350

- Sell committed slots to the BCO at a fixed price, i.e. $7,600

- Take spot exposure at slot

- Guarantee fixed price to customer

- But still secure a fixed $200 profit by hedging spot exposure with futures

- August 2024 spot rate is $9,000

- Earn $1,650 from INE EC 2408 long position

- Receive $7,600 from BCO

- Pay $9,050 to liner

- Net Profit: $200

- August 2024 spot rate is $6,000

- Lose $1,350 from INE EC 2408 long position

- Receive $7,600 from BCO

- Pay $6,050 to liner

- Net Profit: $200

Hedging Example 3.2: Forwarders in a Falling Market

- Spot rates are falling, the market expects lower rates in October

- Liners are flexible and keen to get committed volume

- Clients want a floating price and guaranteed slots for their cargo

- INE EC 2410 futures trade at 3379 (~$5,400)

- Liners are happy to take $5,000 for October shiments

- BCOs want a floating price and sure space for October

- Buy committed slots from liners at $5,000

- Sell INE EC 2410 at ~$5,400

- Sell committed slots to the BCO at index-linked rate minus $50 as an added incentive

- Take spot exposure at cargo

- Pay fixed price to liner

- But still secure a fixed $350 profit by hedging spot exposure with futures

- October 2024 spot rate is $9,000

- Lose $3,600 from INE EC 2410 short position

- Receive $8,950 from BCO

- Pay $5,000 to liner

- Net Profit: $350

- October 2024 spot rate is $3,000

- Earn $2,400 from INE EC 2410 short position

- Receive $2,950 from BCO

- Pay $5,000 to liner

- Net Profit: $350

Speculating with CoFIF

If market participants have no physical market position to hedge, they may still choose to trade futures to benefit from expected price changes in the financial market. The nature of these trades is purely speculative as there is no offsetting position in the underlying commodity.

Speculative traders can be active in both the financial and physical markets to combine the insights gained by operating in the two markets and profit from having more information than other market participants. However, many financial investors are pure paper traders and do not operate in the physical market, while others, especially industrial market participants, engage primarily in physical trading and use the futures market for hedging purposes only.

In most mature futures markets turnover is many times greater than in the physical market and most trading is speculative, with only a small fraction of contracts held until expiry. This is largely due to the leveraged nature of futures trading: opening a position requires only the payment of initial margin instead of the full contract value.

Furthermore, as contracts approach their expiry date, this margin requirement is typcially raised by the exchange to ensure anyone holding the expiring contract is capable of paying the full value of the contract. Thus, trading volume and open interest gradually shift over to the following contract months.

The presence of both speculators and hedgers in the market is fundamental to its effective functioning as every single trade requires two parties willing to hold opposite positions - a buyer and a seller. A liquid market also makes it easier for hedgers and speculators to open or close large positions without significantly impacting the market price.

Directional Trading

If a market participant holds the view that the price of a specific contract will likely rise or fall, they can express this view in the futures market by taking a directional position, i.e. buying or selling that contract. Buyers will benefit when the price of the contract rises, while sellers will profit if the price falls.

This is the simplest position a market participant can hold and the potential profit or loss can be calculated as follows:

Position Profit/Loss = (Sell Price - Buy Price) × Contract Multiplier × Number of Contracts

-

Example 1

A bought 10 INE EC 2408 contracts at 2000, then sold them for 2500

Profit = (2500 - 2000) × 50 × 10 = 500 × 50 × 10 = 250,000

-

Example 2

B bought 10 INE EC 2408 contracts at 2000, then sold them for 1800

Profit = (1800 - 2000) × 50 × 10 = -200 × 50 × 10 = -100,000

-

Example 3

C sold 10 INE EC 2408 contracts at 2000, then bought them back for 2500

Profit = (2000 - 2500) × 50 × 10 = -500 × 50 × 10 = -250,000

-

Example 4

D sold 10 INE EC 2408 contracts at 2000, then bought them back for 1800

Profit = (2000 - 1800) × 50 × 10 = 200 × 50 × 10 = 100,000

Calendar Spread Trading

Calendar spreads allow traders to express a relative instead of an absolute view of the market by avoiding the impact of overall market movements. Instead, the profit/loss comes from the relative performance of different contract months.

For example, if a physical market participant notices strong demand for cargo in December, this may be a sign that Q1 demand in Europe is overall stronger than expected and this may put pressure on freight rates to rise. Just like before, the market participant could simply buy EC 2412 contracts, wait for prices to rise in response to the demand pickup and then sell the futures at a higher price.

However, this demand increase is not happening in a vacuum - other factors could affect freight prices in general, such as a resolution to the Red Sea crisis and re-opening of the Suez Canal for Asia-Europe cargo. The price impact would likely be significant and outweigh the impact from increased demand for imports from China in Europe and the above directional trade might incurr a loss.

As the market participant has no chance to predict the occurrence of such geopolitical events, a simple directional position may be unsuitable in this scenario. Instead, they could use a calendar spread to express their conviction that the December contract is likely to perform better than the October contract.

By buying EC 2412 while simultaneously selling EC 2410, the market participant can express this relative view independent of whether the overall freight rates rise or fall. All that matters is that EC 2412 would rise relatively more or fall relatively less than EC 2410 because of the added effect of stronger demand from Europe in December.

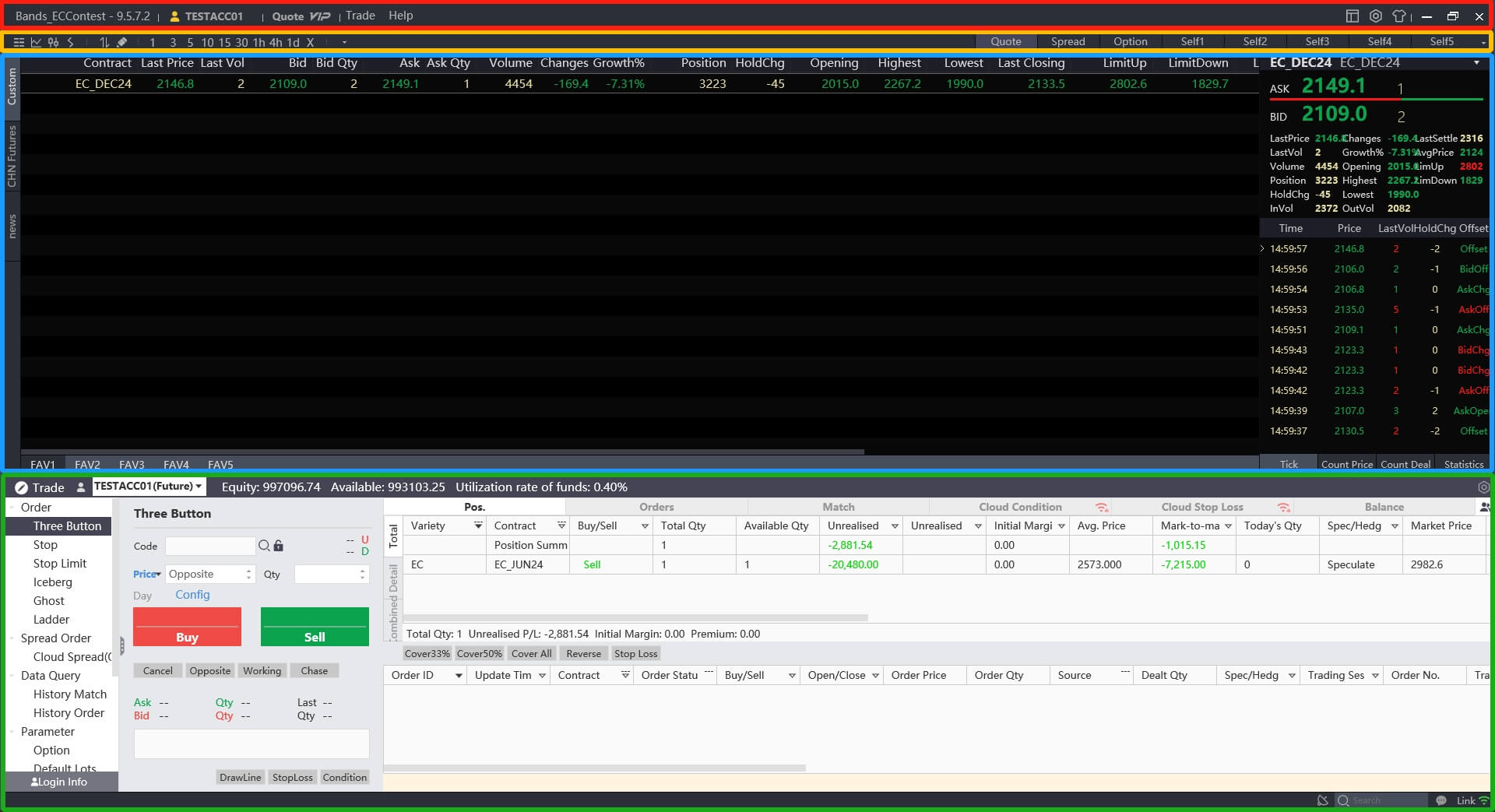

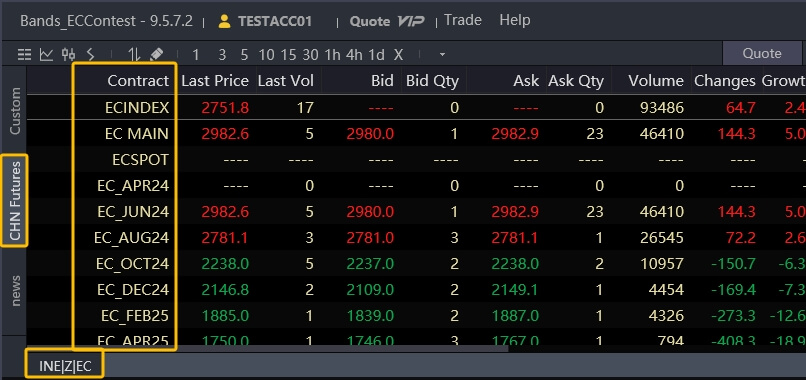

Example: Trading Stronger December Demand

Expecting the December contract to perform better than the October contract, we buy 1 lot EC 2412 and sell 1 lot EC 2410 at the prevailing market price:

- Buy 1 lot EC 2412 at 2146.8

- Sell 1 lot EC 2410 at 2238.0

Unexpectedly, the Red Sea crisis is resolved, enabling unimpeded Suez Canal transits. Capacity employed on routes around the Cape of Good Hope becomes available again for shorter Suez Canal voyages, increasing supply and prices fall across the board. However, the our expectation of stronger December demand also materialises and so while EC 2410 falls by 40%, EC 2412 performs relatively stronger, falling only 35%. We now sell EC 2412 and buy back our EC 2410 contract to close our position:

- Sell 1 lot EC 2412 at 0.65 × 2146.8 = 1395.4

- Buy 1 lot EC 2410 at 0.6 × 2238.0 = 1342.8

Using our profit/loss formula from above, we get:

- December profit = (1395.4 - 2146.8) × 50 × 10 = -751.4 × 50 × 1 = -37,570

- October profit = (2238.0 - 1342.8) × 50 × 10 = 895.2 × 50 × 1 = 44,760

- Net profit: -37,570 + 44,760 = 7190

Had we only bought the December contract, we would have been exposed to the overall market impact, but we essentially hedged against this by selling the October contract. While our December long position lost money, our October short position was profitable; and because December demand still increased, that loss was smaller than the October profit.

Note 1: This 'hedge' is imperfect: because the October and December contracts have different prices, an equally large change in percentage terms would still lead to a (small) non-zero net profit/loss.

Note 2: An important implied assumption in this case is that the resolution of the Red Sea crisis would in fact impact all contract months equally.

Esunny User Guide

Participants will use the Esunny trading platform to execute trades in a simulated environment based on the real INE marketplace. Esunny comes with access to market data, technical analysis and trading tools and allows users to keep track of their real-time account balance and trading profits & losses.

-

Click here to download Esunny, then double-click on the BANDS_ECContest.exe file to install it.

Note: The installer needs administration privileges to run. Please check with your company's IT department before installing Esunny on a company PC. If the BANDS_ECContest.exe file does not appear in your download folder, your PC's antivirus software may have quarantined or blocked the file. In this case you will need to manually permit the program to run.

-

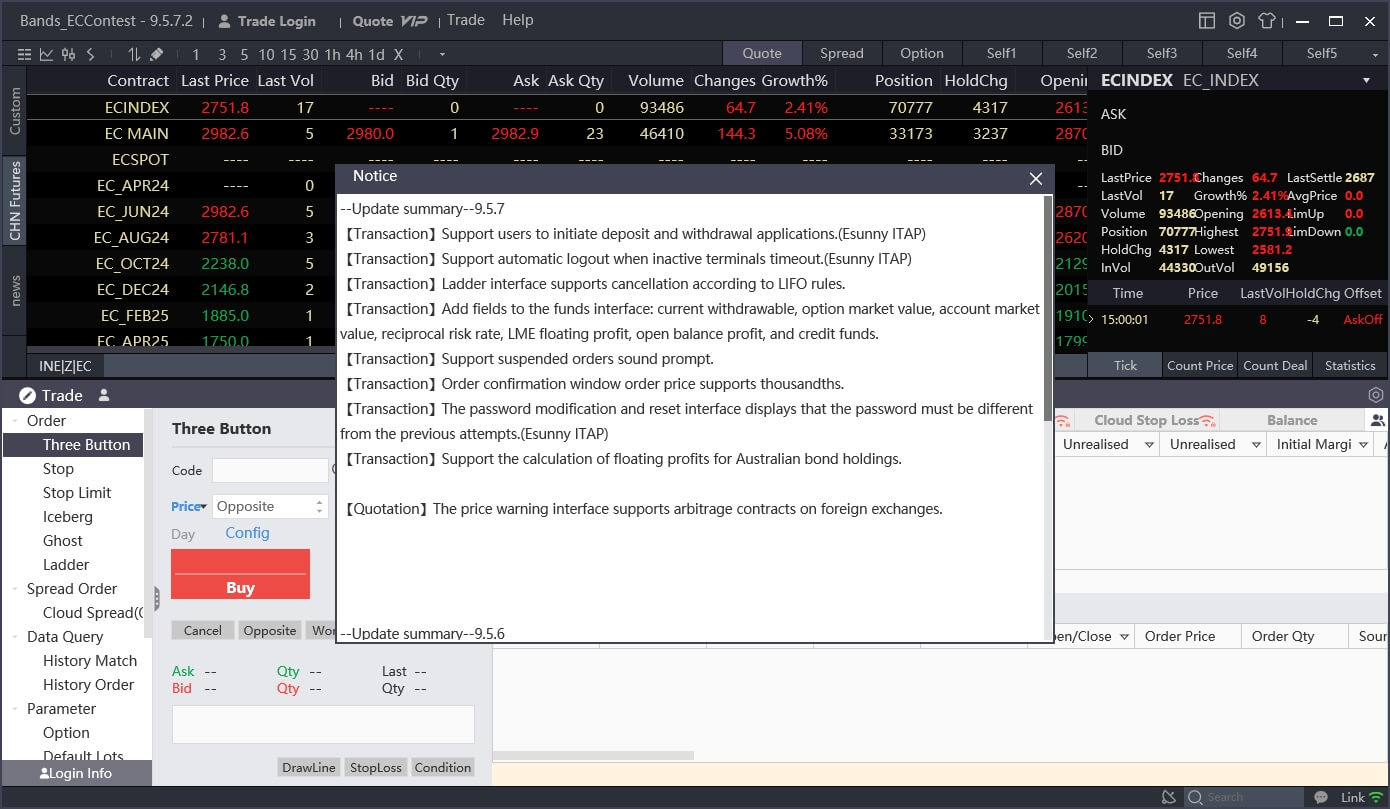

Upon launching Esunny for the first time, the installer will run and download the latest updates automatically. Click on 安装 ("install") to start the installation.

Note: Esunny was initially developed for the Chinese futures market and will initially start in Chinese. After launching it for the first time, the language can be changed to English. This guide will cover all steps to help users through the initial Chinese-language installation process.

-

Once the installation is complete, click on 打开 ("start") to launch Esunny.

Esunny will open after loading.

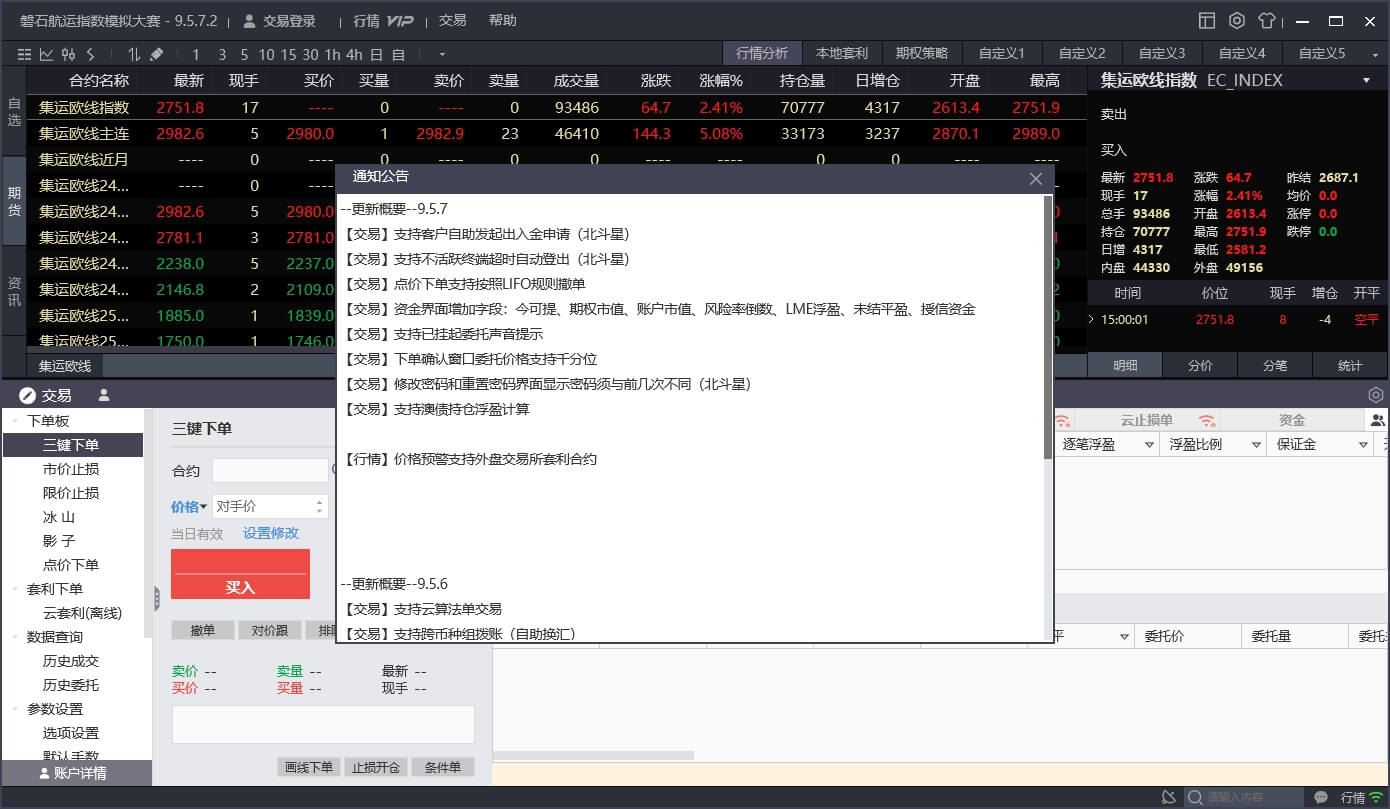

The initial home screen will be in Chinese, with a sub-window listing the latest updates.

-

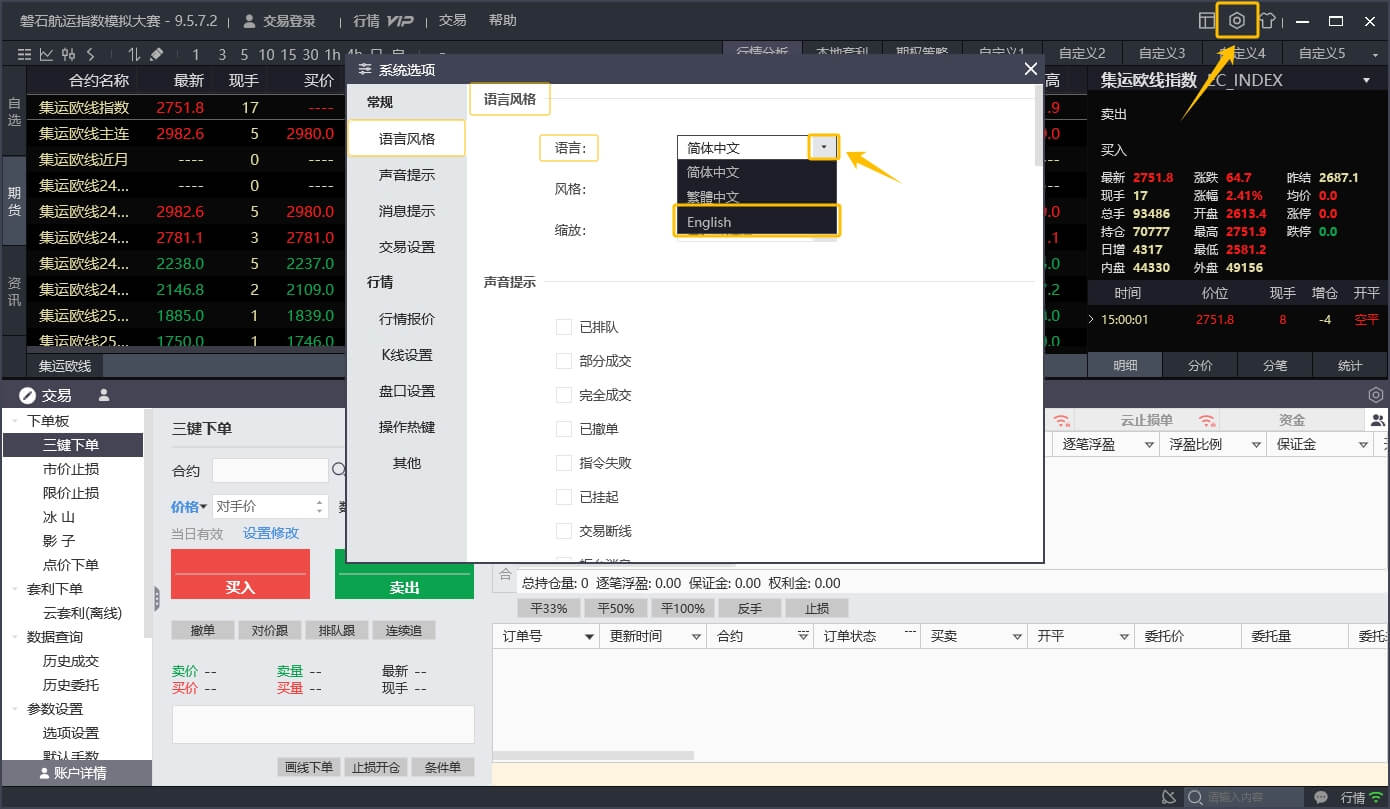

In the upper-right corner of the screen, click on the settings icon. A new window will open with a drop down menu called 语言 ("language") at the top. Click on the drop-down menu and select English.

After selecting English, the drop-down menu will close and the message 重启生效 ("restart to activate") will appear in red to the right of the drop-down menu. This means the new language was selected successfully. Close Esunny and start it again to activate the new language setting. This is now the default language and Esunny will start in this language from now on.

-

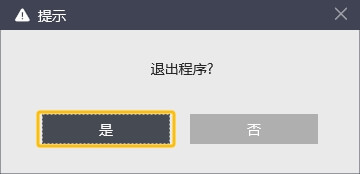

When closing Esunny, a confirmation window will appear, asking you to confirm that you wish to close the program. Click on 是 ("yes") to confirm and Esunny will close.

-

By default, Esunny will be installed in the following directory: C:\Users\User_Name\AppData\Local\EPolestar220395v9.5

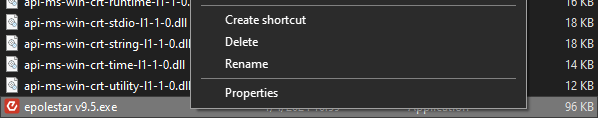

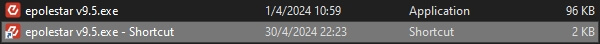

To launch Esunny after the initial installation and launch, go to this folder after replacing User_Name with your PC user name and double-click on the epolestar v9.5.exe file in the directory.

Note: If Esunny is not installed in the above directory, it may be installed here: C:\Users\User_Name\AppData\Roaming

For convenience, you can also create a shortcut by right-clicking on the file and clicking on Create shortcut.

This creates a short cut, epolestar v9.5.exe - Shortcut, which you can rename and place in your desktop folder for example.

You can also pin Esunny to your taskbar when it is open by right-clicking on the Esunny logo at the bottom of your taskbar and selecting Pin to taskbar.

-

Once you have a created your shortcut or pinned Esunny you can launch it more conveniently from there. Now Esunny will start up in English and you will see the default English language home screen.

-

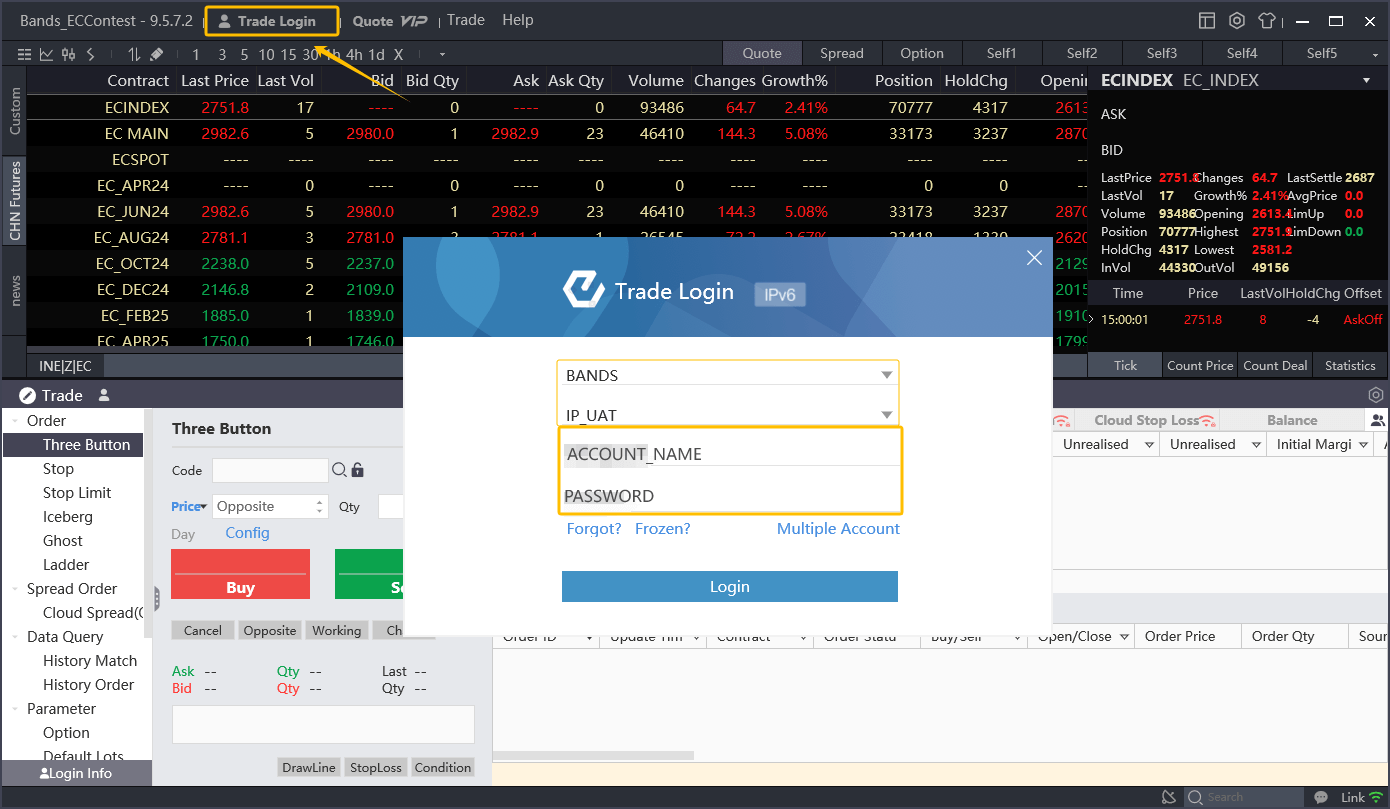

Every competition participant will receive a trading account for the duration of the competition. The login information will be sent to the participant's correspondence email address. To log in with this account, click on Trade Login in the upper-left corner of the screen. The Trade Login window will open. By default, the trading environment and server settings are set to BANDS and IP_UAT. These settings do not need to be changed. Enter your trading account name and password, provided to you by email, and click on Login.

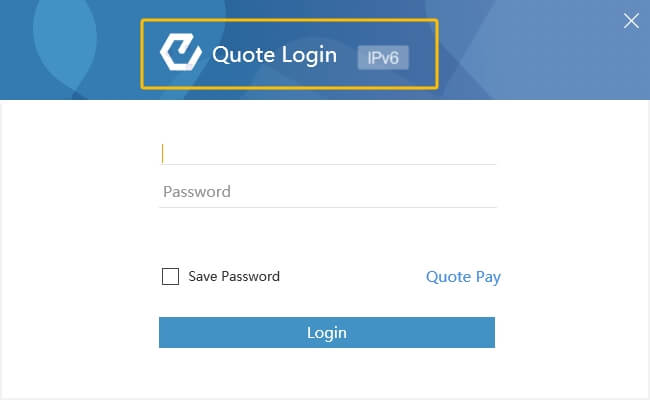

Note: The Trade Login is separate from the optional Market Data login. This version of Esunny already comes with the INE EC futures market data by default and additional market data is not required. Participants do not have a market data account.

-

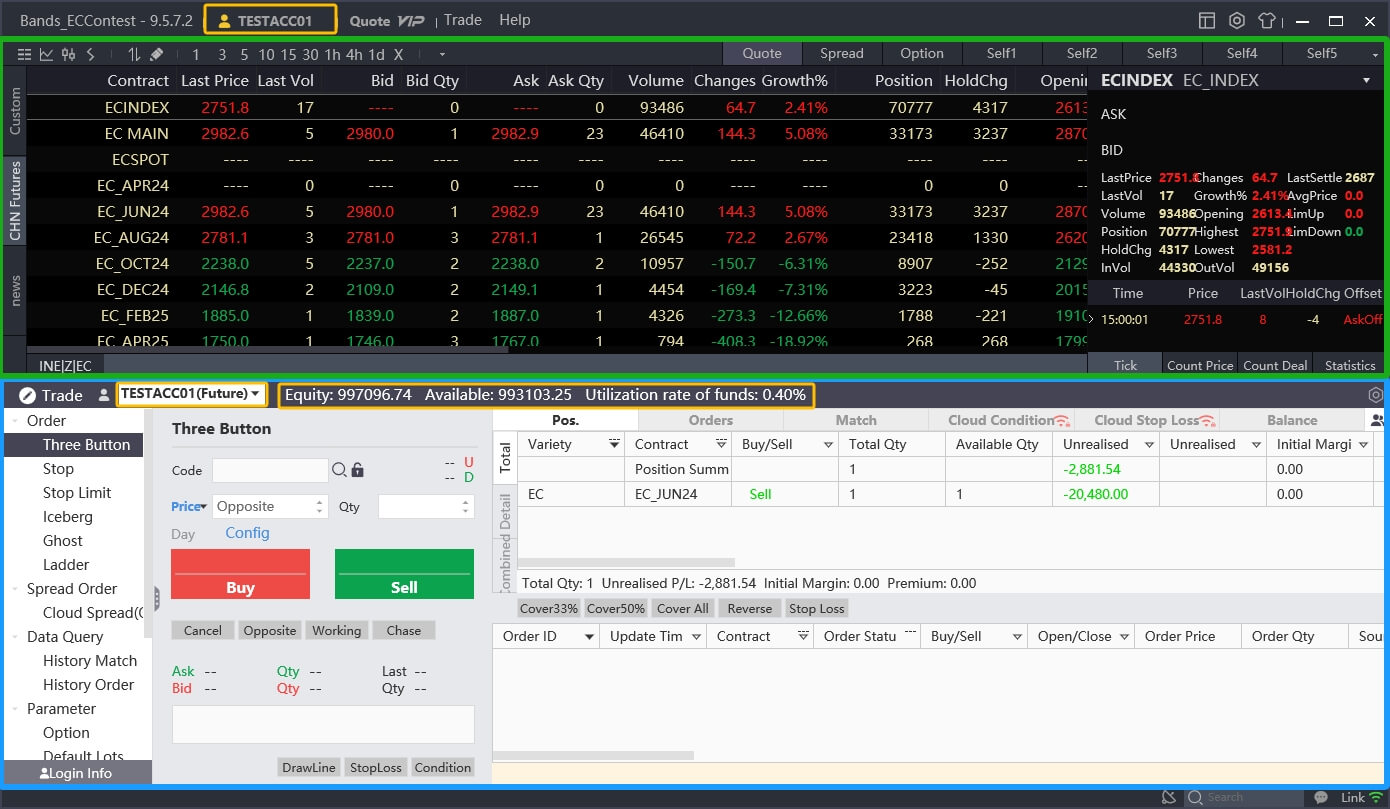

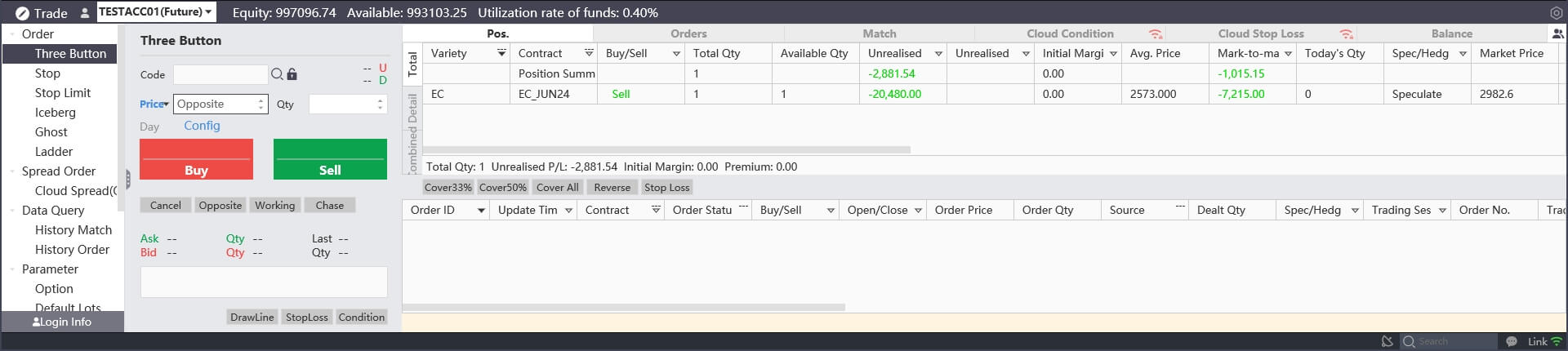

Once logged in, participants can see their account information. In the upper-left corner the account name is displayed. Just below the account name is the market data window (marked in green). The trading window (marked in blue) occupies the bottom half of the screen. Here, participants can once again see their account name, along with their total account equity, available funds (i.e. funds that can be used for trading) and fund utilisation rate.

-

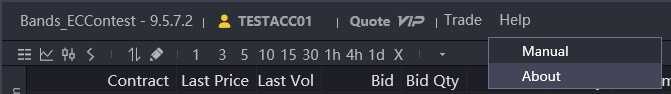

At the top of the screen is the Help menu.

In this menu, users can click on About to see their detailed Esunny version number in case this information is necessary to resolve any technical issues.

In this menu, users can click on About to see their detailed Esunny version number in case this information is necessary to resolve any technical issues.

-

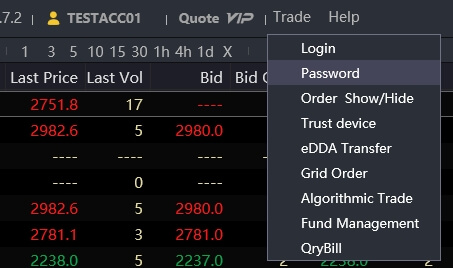

To change the password, click on the Trade button at the top of the screen. In the dropdown menu, click on Password to open the password screen and change it.

Note: In case you forgot your password, please contact us to reset your trading account password.

-

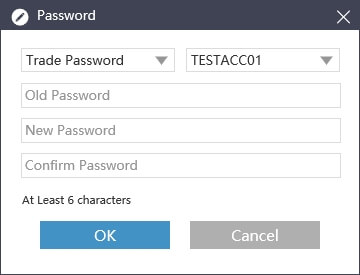

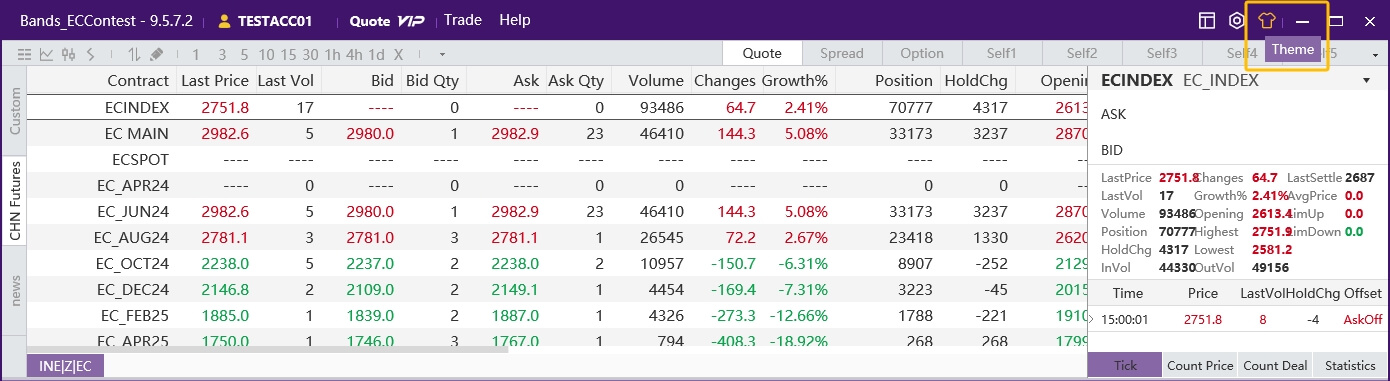

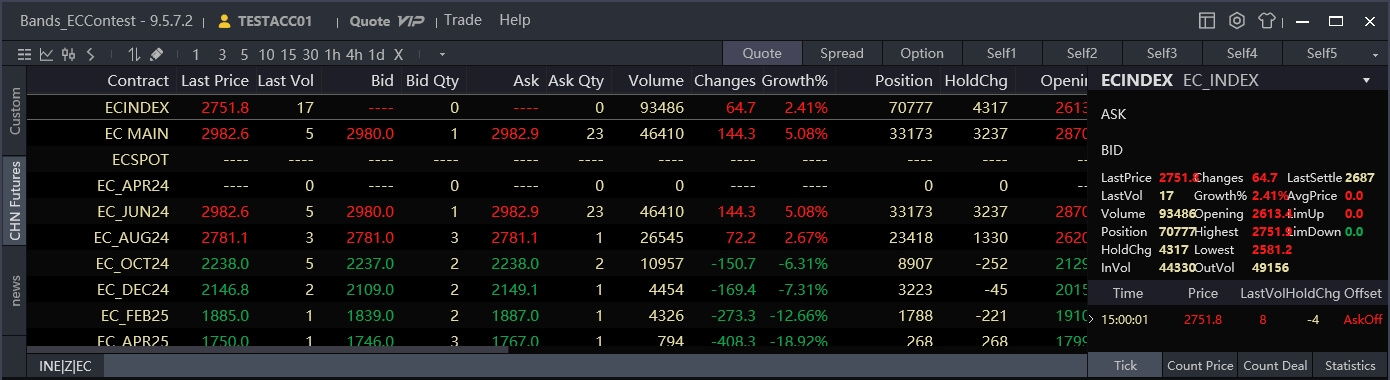

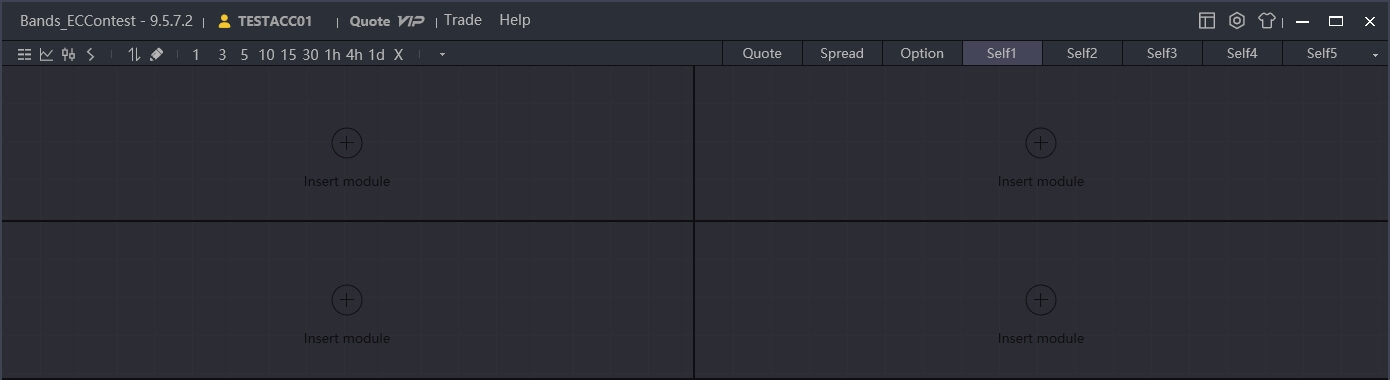

The Esunny home screen consists of several sections. From top to bottom, these sections are:

The Esunny home screen consists of several sections. From top to bottom, these sections are:

1. Settings bar (red): Account and program settings

2. Market data bar (yellow): Market data and technical analysis settings and tools

3. Market data window (blue): Available contracts & contract market data

4. Trading window (green): Execute trades and view positions, funds and orders; hide/display by pressing the space bar -

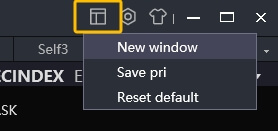

The settings bar contains three icons in the upper-right corner:

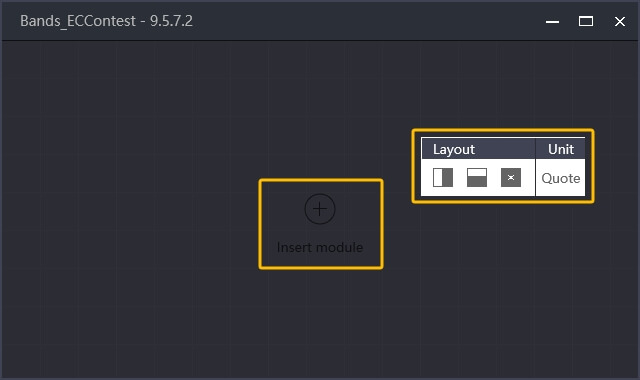

The layout button opens a new menu with options to modify, save or reset the current Esunny layout. Clicking on New window opens additional Esunny windows that allow the user to further customise the layout.

Right-click to split the new window vertically or horizontally and click on Quote to add configurable market data.

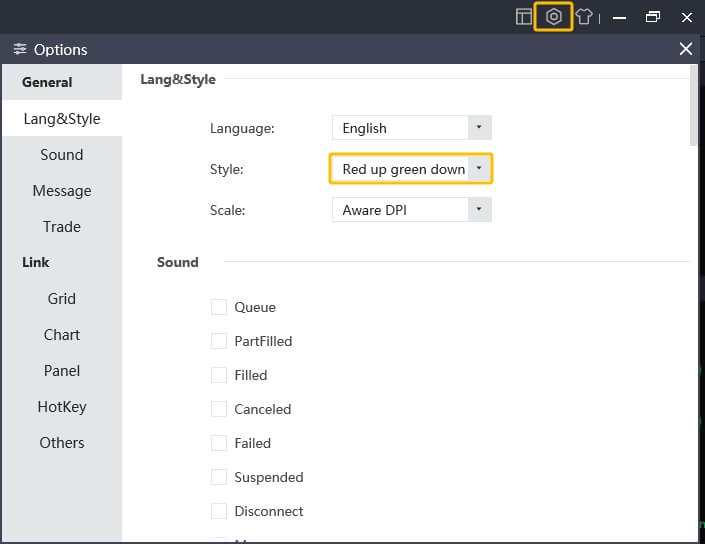

Right-click to split the new window vertically or horizontally and click on Quote to add configurable market data.The settings button opens a new window for adjusting the appearance, sound and trade options. Western users may wish to swtich the Style option from Red up / green down to the opposite setting so that rising prices are marked in green and falling prices in red. Due to differing cultural connotations the default setting is inverted in Esunny.

The theme button switches the Esunny colour scheme between the dark and light options.

-

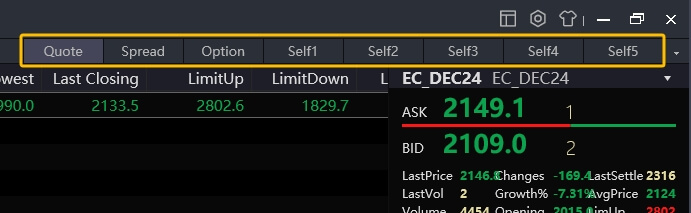

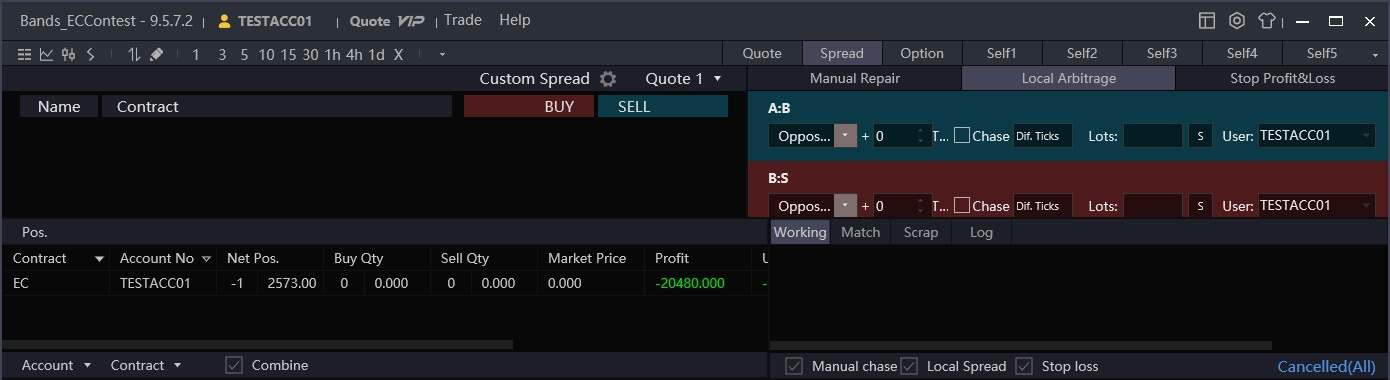

The market data bar contains market data analysis options on the left and a list of different tabs on the right. The market data analysis options are discussed in more detail in the Market Data and Technical Analysis sections below. The tabs include Quote, Spread, Option and several Self windows that can be customised by the user.

Quote is the default window and includes primarily market data.

The Spread window is used for trading spreads or simple strategy orders and allows the user to buy or sell multiple contracts simultaneously based on certain specified conditions. The Trading section below will introduce this window in more detail.

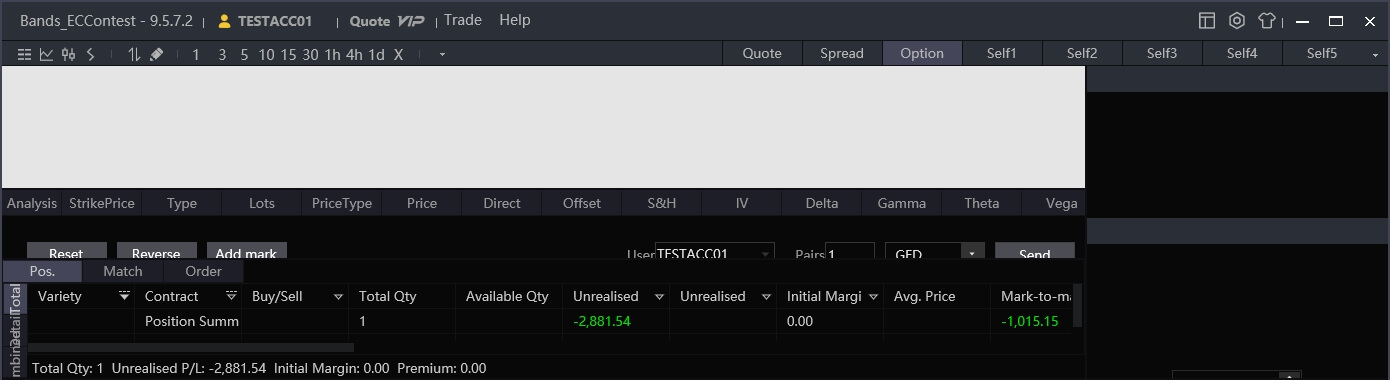

The Option window contains market data and trading tools for buying and selling options. There are currently no available container freight option contracts, so this window can be disregarded.

The Self windows are customisable by the user.

-

The trading window can be hidden/displayed by pressing the space bar. It contains tabs to display the user's current positions, orders, filled (matched) trades and fund balance on the right side and the order section on the left. The Three Button order is the default option and allows users to buy or sell contracts. The Trading section below covers these features in more detail.

-

By default, the market data window is set to display the available INE EC futures contracts, including bi-monthly contracts (EC_JUN24, EC_AUG24, etc.), EC MAIN, EC INDEX and EC SPOT. EC MAIN, EC INDEX and EC SPOT are not actual contracts but instead refer to certain contracts and are useful for anlysing the market over a longer period of time or as a whole instead of a specific contract.

EC MAIN refers to the main contract, i.e. the EC contract with the highest trading volume - in this case, EC_JUN24.

ECINDEX refers to the EC market as a whole, i.e. the trading volume & open interest, for example, are the sum of all individual contracts' values.

ECSPOT refers to the front (spot) month contract - in this case, EC_APR24.

-

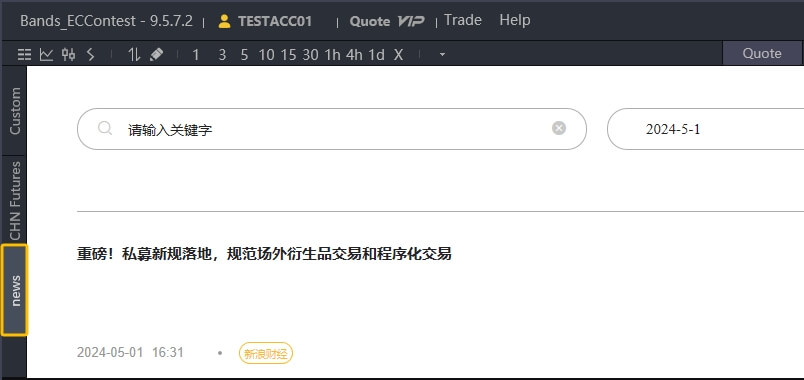

On the left of the market data window is a vertical sidebar with three tabs: news, CHN Futures and Custom.

CHN Futures is selected by default. This section shows Chinese market contracts; in this version, the tradeable contracts are limited to INE EC futures, so no other contracts or exchanges are shown.

news is an inbuilt market news aggregator, however at this point it is limited to Chinese-language news articles.

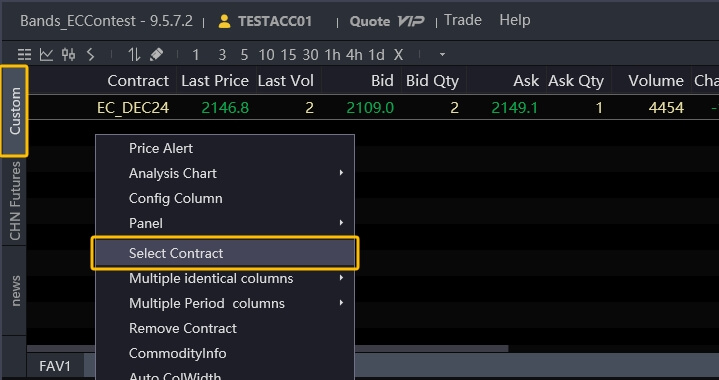

Custom is a customisable version of the CHN Futures window. Users can add or remove specific contracts here by right-clicking and then clicking on Select Contract in the menu that appears.

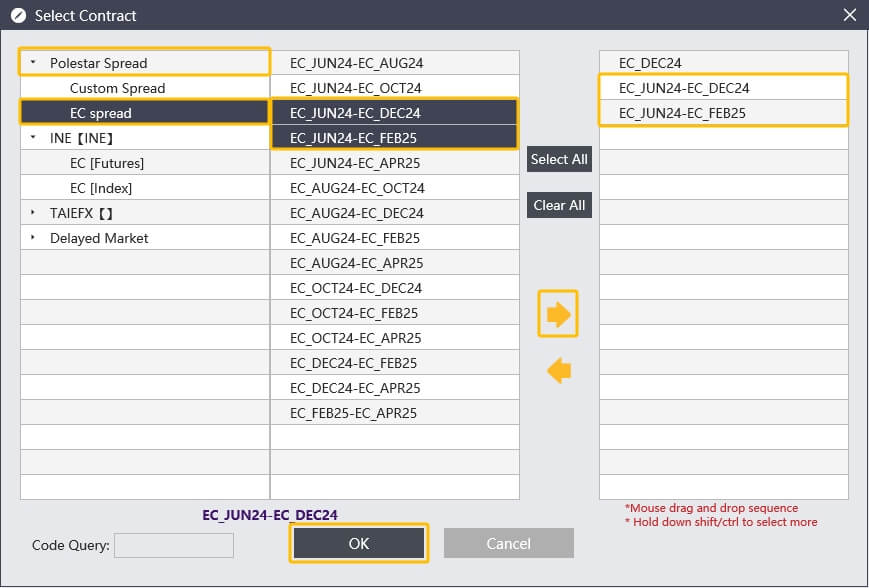

This opens a new window; to add or remove specific contracts, choose a contract category in the left column, then select one or more contracts in the centre column (hold the "Ctrl" key to select several contracts at once) and click on the upper yellow arrow to add them to the right column. This column is where all the contracts that will be displayed in the Custom window are listed. To remove contracts, select them in the right column and click on the lower yellow arrow. Click OK to confirm.

In this example, we have added to calendar spread contracts, EC_JUN24-EC_DEC24 and EC_JUN24-EC_FEB25, to the Custom screen. EC_DEC24 was added earlier and is thus listed in the right column already.

In this example, we have added to calendar spread contracts, EC_JUN24-EC_DEC24 and EC_JUN24-EC_FEB25, to the Custom screen. EC_DEC24 was added earlier and is thus listed in the right column already. -

Right-click anywhere in the market data window to bring up a menu with further options to change the appearance, content and view. Click on Config Column to hide/display certain columns or drag and drop them to re-arrange the column order.

-

Double-click on a contract to quickly change from the table view to the chart view. The chart view shows current and historic price, volume and open interest data for the selected contract. Scroll up or down using the mouse wheel to swtich between contracts. Click on the (upper) price chart to display the price and date values for your current cursor position.

-

Use the menu in the upper-left corner to switch between different presets (intraday, candlestick and tick-level data) or select a different time interval, with options ranging from individual price ticks to sampled data from 5 seconds to 1 year or a custom user-specified time interval.Click on the first option, Grid, to return to the initial table view.

-

Press space to open or close the trading window

The trading window consists of four sections:

The trading window consists of four sections:

1. Account summary (yellow): Displays the active account name and fund overview

2. Order options (blue): Lists different order types and settings

3. Send order (red): Send orders to buy or sell contracts

4. Account information (green): Displays position, order, filled trade and balance details In the top bar, click on the icon in the right corner to open or close the order options and send order tabs.

-

To buy or sell a contract, click on Three Button in the order options table on the left. This is the default order setting.

-

To select a contract, either click on the contract in the market data window above or click on the text entry field and type the contract code. Alternatively, click on the search icon to its right to select the desired contract from a list. The lock icon can lock or unlock this text entry field.

-

Change the order quantity in the text field on the right by typing a number or using the up/down arrows.

Note: You can only buy or sell 50 contracts at the same time. To sell more than 50 contracts, simply place multiple orders. This fat finger limit is applied to avoid accidental large orders in case traders mistakenly add too many 0s.

-

Change the price in the same way as the order quantity. By default, Esunny pre-fills the current bid/ask (opposite) price when selecting a contract. Click on the price input field to display or change the price.

In the top right corner, Esunny shows the current upper and lower price limits for the day. Any order outside this price range will be rejected automatically.

-

Use the three order buttons to buy, sell and close out a position.

Note: In the Chinese market, it is possible to hold both long and short positions simultaneously, i.e. when buying 10 lots of INE EC 2408, a long position is created. Upon using the green sell button to sell 5 lots, the new position will not be 10 - 5 = 5 lots long - instead, it will be 10 lots long and 5 lots short.

This has no impact on the profit or loss of the position, but both the long and the short position will continue to use up initial margin. To close out a position, use the grey Cover button. Instead of opening a new 5 lot short position, it will close out 5 lots of the long position, resulting in a smaller 5 lot long position in the end.

If you encounter any technical issues or have further questions about Esunny, please don't hesitate to contact us at bands-cup-2024@bandsfinancial.com.

Rules

Company League

Competition start

3 Jun 2024, 08:55 HKT

Competition end

29 Nov 2024, 15:00 HKT

Trading hours

09:00-10:15

10:30-11:30

13:30-15:00

Beijing Time (GMT+8)

Tradeable product

INE EC Shanghai-North Europe Container Freight Index Futures (CoFIF)

Trading & market data platform

Esunny

Beginning account balance

RMB 80,000,000

Trading requirements

Contestants need to deploy at least 75% of their funds no later than the end of June. Contestants who fail to meet this requirement by the end of each week will be subject to a penalty of RMB 4,000,000.

Fat finger limit

50 contracts

Exchange rules

Contract margin and fee levels are subject to adjustment by the INE.

Commission fees

Contestants are charged RMB 0.0012 × Contract Value per trade, subject to any exchange fee premiums and discounts.

Cash Settlement

If a contestant holds a contract until expiry, the contract will be cash settled in accordance with the exchange rules.

Margin Call Policy

If the account equity is negative on any trading day at 14:40, loss-making positions will be closed out following the first in, first out principle until the account equity is positive. The liquidation will run for 15 minutes. Participants subject to forced liquidation will not be able to open new positions until the market closes at 15:00.

Algorithmic trading

Algorithmic or program trading is not permitted.

Individual League

Competition start

3 Jun 2024, 08:55 HKT

Competition end

29 Nov 2024, 15:00 HKT

Trading hours

09:00-10:15

10:30-11:30

13:30-15:00

Beijing Time (GMT+8)

Tradeable product

INE EC Shanghai-North Europe Container Freight Index Futures (CoFIF)

Trading & market data platform

Esunny

Beginning account balance

RMB 8,000,000

Trading requirements

Contestants need to deploy at least 75% of their funds no later than the end of June. Contestants who fail to meet this requirement by the end of each week will be subject to a penalty of RMB 400,000.

Fat finger limit

50 contracts

Exchange rules

Contract margin and fee levels are subject to adjustment by the INE.

Commission fees

Contestants are charged RMB 0.0012 × Contract Value per trade, subject to any exchange fee premiums and discounts.

Cash Settlement

If a contestant holds a contract until expiry, the contract will be cash settled in accordance with the exchange rules.

Margin Call Policy

If the account equity is negative on any trading day at 14:40, loss-making positions will be closed out following the first in, first out principle until the account equity is positive. The liquidation will run for 15 minutes. Participants subject to forced liquidation will not be able to open new positions until the market closes at 15:00.

Algorithmic trading

Algorithmic or program trading is not permitted.

Further information can be found in the Competition Terms & Conditions. Any errors, omissions, or discrepancies in competition related materials and trading activity that occur before, during or after the competition are subject to resolution by BANDS without exception.